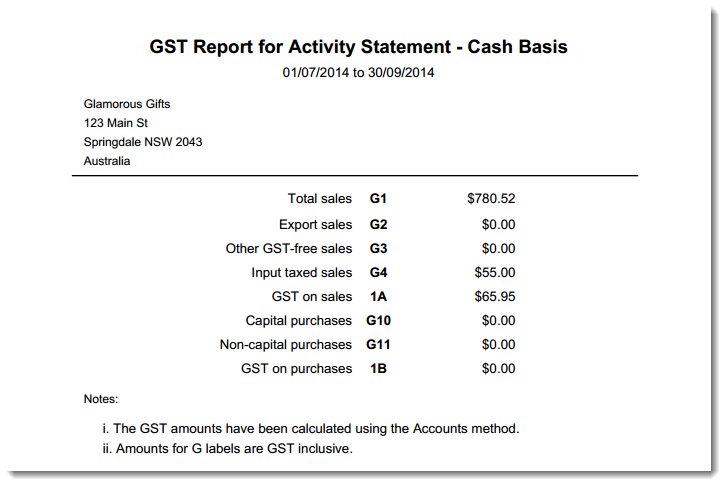

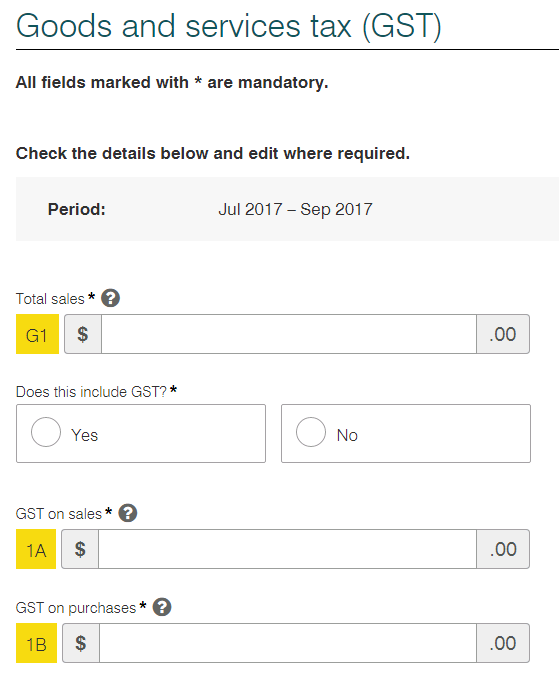

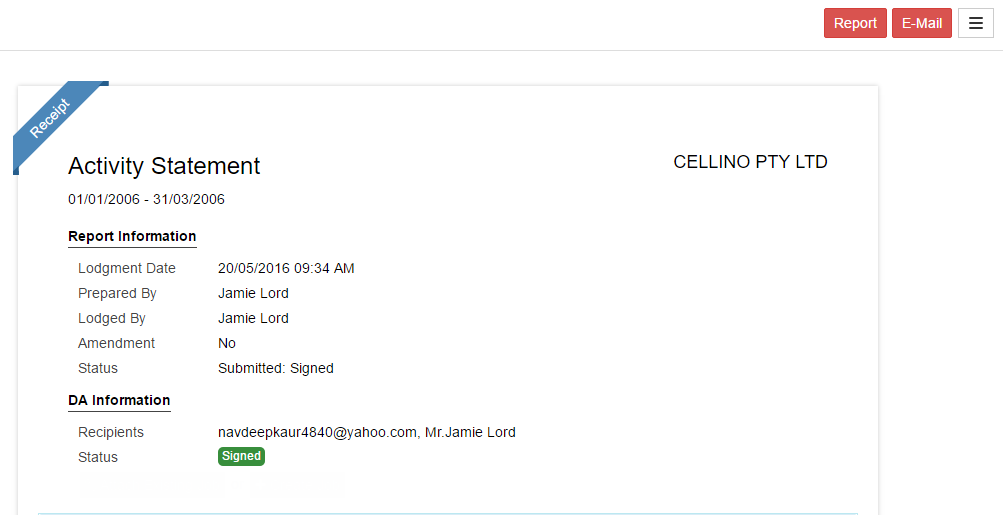

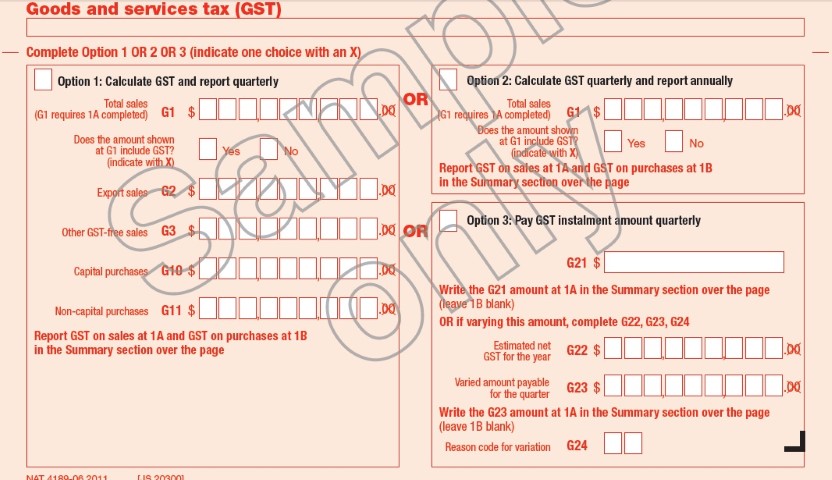

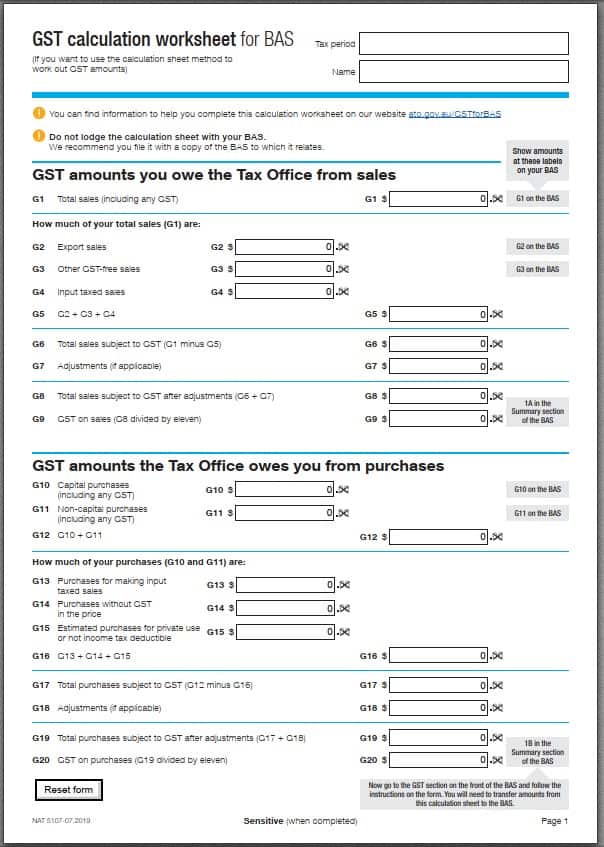

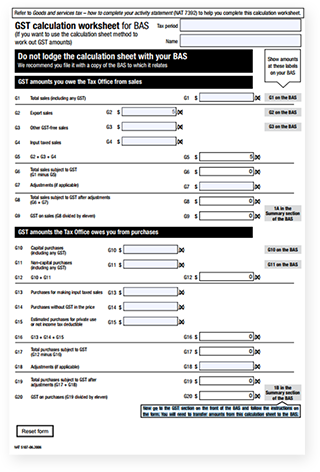

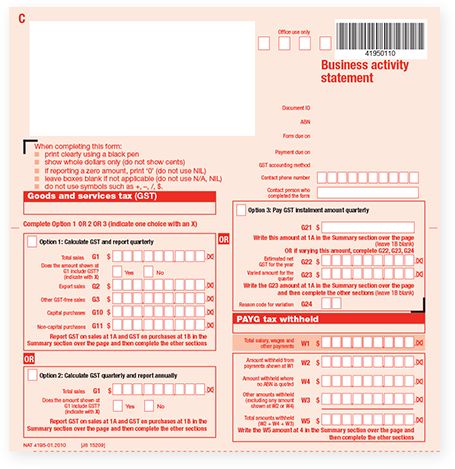

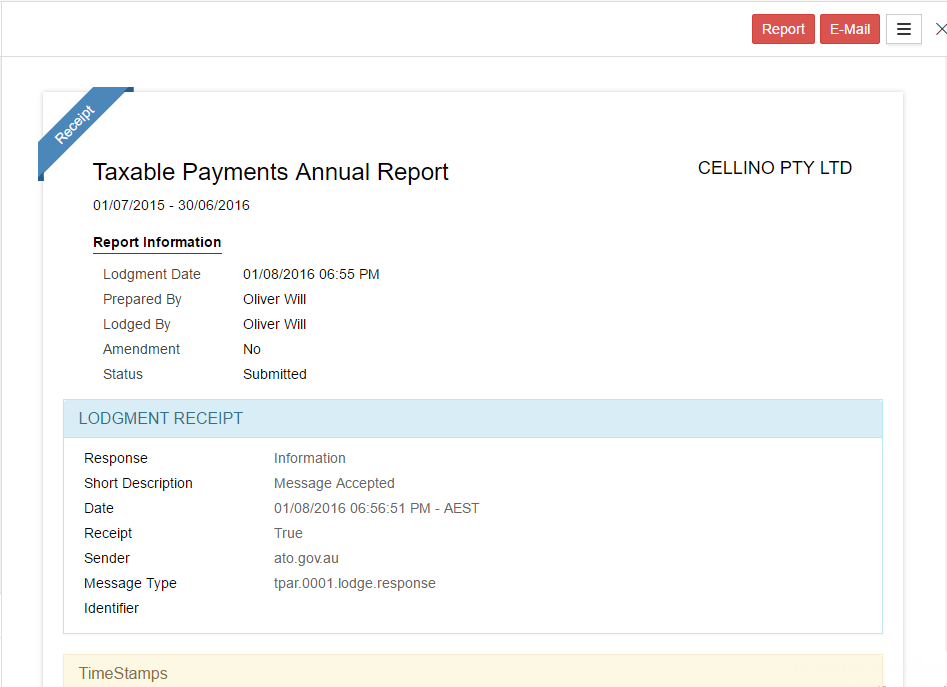

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

![How to understand ato accounts and download the ica statement [ato bas portal] | Evolution Cloud Accounting How to understand ato accounts and download the ica statement [ato bas portal] | Evolution Cloud Accounting](https://s1-production.s3-us-west-2.amazonaws.com/17589/7fc021c2-a4f7-4a81-a206-406aa35ff10c/tickets/0/b438715b-acd4-4e2b-9e1b-1f37fc7e6a39/5dd9abdc1b96421c945a09bd0d132359.png)